Fringe Benefits Rates Office for Sponsored Programs

Content

FY 2023 The rates and amounts below were charged to projects from July 2022 to June 2023. Fringe benefits are budgeted on proposals as direct costs using rates that have been approved by the US Department of Health and Human Services (DHHS). This means your company is paying an additional 25% on top of the base salary for the employee.

Fringe benefits are supplements to salaries and wages given to employees. They cover FICA/Medicare, retirement, healthcare insurance, unemployment insurance, tuition remission, TIAA/CREF, and worker’s compensation. Departments should calculate and budget fringe benefits when personnel budget is being created using non-personnel budget by referring to the policies below. At the beginning of the fiscal year, Fringe Benefits Rates a $0 budget must be created, as the budget exception needs to have override ability in order for payroll to process. After each payroll is run, an allocation is processed to transfer fringe budgets from the pool and to roll up to each chartfield string – the amounts must net $0. The fringe rate charged to the department on an employee’s earnings is not determined by the (ARC) account number used.

Offices & Departments

Through June 30, 2021, the DUCOM highly compensated faculty rate, referred to in our agreement with DHHS as Clinical Faculty Rate, is specific to full-time, benefit eligible, College of Medicine faculty in the “F5” employee class. College of Medicine faculty are automatically assigned to the highly compensated employee classification on hire or when their base salary reaches the annual threshold. RFCUNY maintains its own fringe benefits program for employees (comparable to those of other academic and non-profit institutions). The cost of providing benefits to employees is included in grants as a direct charge. The Department of Health and Human Services (DHHS) formally approves our federal fringe benefit rates. These fringe benefit rates should be used for budgeting and long range planning purposes, as well as when preparing grant applications that cross fiscal years.

- 4A breakdown of the fringe benefits components can be found below.

- Keep in mind that some fringe benefits are only nontaxable in certain situations.

- Research Accounting Services is responsible for the submission of the fringe benefit rate proposal to the Department of Health and Human Services.

- No increments may be added to the current fringe rate for future years’ budgets.

- The part-time employee rate includes both part-time benefit eligible and non-benefit eligible employees (e.g. temporary employees, co-ops).

Employee benefit rates (fringe rates) for use in sponsored project proposal budgets. Northwestern University applies distinct employee benefit rates in the compensation of its personnel. These rates are charged to sponsored projects from which Northwestern personnel are paid. For questions related to eligibility under any of the rate categories, see HR Benefit Eligibility. The percentages used to allocate the cost of fringe benefits are established annually by the Vice President of Finance, but may be revised during the year if necessary.

What is a Fringe Benefit Rate?

FY 2020 The rates and amounts below were charged to projects from July 2019 to June 2020. FY 2021 The rates and amounts below were charged to projects from July 2020 to June 2021. FY 2022 The rates and amounts below were charged to projects from July 2021 to June 2022.

In addition, a Federal rate is calculated which is the same as the benefit eligible rate, excluding unallowable dependent tuition remission benefit expenses. This rate is only applied to salaries charged to Federal awards. Our sponsors will reimburse us for fringe benefit costs, expressed as a percentage of total salaries. As salaries and FB can represent the largest component of cost on a given project, the University negotiates its FB rates with the federal government on an annual basis. Two sets of fringe benefit rates are specified for each fiscal year.

Fringe Benefit Rates for Fiscal Year 2022-23

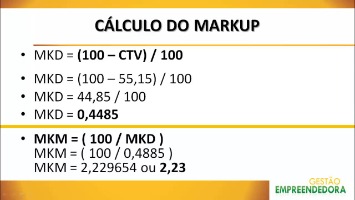

The fringe rate shows you how much an employee actually costs your business beyond their base wages. A fringe benefit rate is the percent of an employee’s wages relative to the fringe benefits they receive. Calculate a fringe benefit rate by dividing the cost of an employee’s fringe benefits by the wages they receive. Although fringe benefits are typically taxable, some are nontaxable. Taxable fringe benefits can include personal use of a company car, bonus pay, and paid time off.

The “Federal” rates will be used for federal grants and contracts and for Duke Regional Hospital and Duke Raleigh Hospital. The “Non-Federal” rates will be used for all other entities including non-federal grants, contracts, departments, etc. To simplify both pre-award budget preparation and post-award accounting procedures, RFCUNY developed a https://kelleysbookkeeping.com/ system of Multiple Fringe Benefits Pools. Each grant is charged a flat percentage of each employee’s gross annual wages, based on their classification. The percentages represent the best estimate of the actual costs of providing benefits to each employee. Employers can use a fringe benefit rate to examine the total cost of labor per employee.