Accounting Explained With Brief History and Modern Job Requirements

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities. The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company’s operations, financial position, and cash flows. Wave is a web-based accounting solution built for small businesses.

Companies with little or no inventory and few employees can use inexpensive or free basic accounting software. While business owners can easily implement this affordable software, it may leave you at risk of an IRS audit triggered by inaccurate reporting. When you first start your small business, you’ll likely have to take on many day-to-day administrative tasks yourself, including accounting. Knowing how to track and project your business income and expenses are important skills for business success, so it’s important to familiarize yourself with the fundamentals of accounting. Students draw upon knowledge learned throughout the program to participate in weekly duties that simulate authentic business practices.

Do You Need a CPA?

If this is your first time exploring small business accounting, visit our helpful glossary to become familiar with basic accounting terms. It is a workplace expectation that students are comfortable using accounting software on a day-to-day basis. Students gain practical experience using computerized accounting software to record transactions and prepare financial statements. Curriculum is delivered in lecture format and by hands-on completion of cases using accounting software. The ability to complete personal tax returns is an essential skill to have in the accounting field.

USI Romain College of Business Accounting Program receives five … – University of Southern Indiana

USI Romain College of Business Accounting Program receives five ….

Posted: Fri, 18 Aug 2023 13:31:40 GMT [source]

At this stage, successful small businesses should consider either outsourcing their accounting needs or investing in accounting software. Each option has its pros and cons, which are outlined in greater detail below. Operating revenue makes up a business’s primary activities, like selling products. Businesses obtain non-operating revenue through secondary business activities, like bank account interest.

Is Income From Operations the Same Thing as Operating Income?

Managing your cash flow is critical, especially in the first year of your business. Forecasting how much cash you will need in the coming weeks/months will help you reserve enough money to pay bills, including your employees and suppliers. Plus, you can make more informed business decisions about how to spend it. Create beautiful invoices, accept online payments, and make accounting easy—all in one place—with Wave’s suite of money tools. The best way to do so is to educate yourself on your business’s tax obligations, keep accurate records, and set aside revenue (or pay ahead in quarterly taxes).

According to Statista, 64% of small businesses use accounting software for their finances. Automated accounting software includes tools like QuickBooks, Xero, and other popular accounting applications. If you’re in charge of accounting, it’s not just numbers and receipts. You’ll use those reports to communicate the cash flows, financial position, and performance of your business. However, working with a CPA offers many benefits for LLCs and corporations. CPAs can analyze bookkeeping records, help with payroll and taxes, offer financial consulting, and represent you during IRS audits.

Balance Your Business Chequebook

These eight steps will introduce you to the accounting process (if you’re not yet familiar) and set you up to scale your business in a sustainable way. But if you’re not an accountant yourself, you don’t need to know everything about accounting — only the practices and parts that have to do with your financial operations, legal obligations, and business decisions. If you limit your accounting to material transactions you can save time for your business. At the same time, you want to make sure that financial information that’s important to stakeholders is easy to access and review. Accountants should aim to provide full disclosure of all financial and accounting data in financial reports.

In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, money is considered to be a measure of a company’s economic performance. Understanding the four basic financial statements, Income Statement, Balance Sheet, Statement of Retained Earnings, and Statement of Cash Flows, is key to evaluating companies for your investment decisions. But this business course goes beyond just understanding these financial statements. Business Accounting Basics takes you through the building blocks and accounting cycles that create each statement.

Learn About Business Accounting and Taxes for Just $30 – TechRepublic

Learn About Business Accounting and Taxes for Just $30.

Posted: Mon, 21 Aug 2023 09:32:29 GMT [source]

In addition, this course will give you the basic tools to project profitability and break your costs down to help analyze any company. In order to keep track of your finances, having a daily record of your transactions is crucial. This is done through a process known as bookkeeping, which is recording your purchases, sales, receipts and payments on a day-to-day basis. While doing so, categorize each transaction into related buckets that are part of the overall income statement and balance sheet for the month.

QuickBooks Online

Students participate in both interactive lectures and on-line discussions, maintain weekly journals, and develop personal strengths through direct engagement with well-being initiatives. Students describe and explore through case studies a range of disabilities and their unique features. Using arts, enquiry and discussion, students critique historical and modern-day portrayals of individuals with disabilities. Students consider the attitudes and social barriers that individuals with disabilities face, and focus on the link between the formation of cultural identity and the arts.

- It is a tool that will help you “account for” what your business has done, is doing, and hopes to do in the future.

- Your liabilities could include a credit card balance, payroll, taxes, or a loan.

- You’ll use those reports to communicate the cash flows, financial position, and performance of your business.

Courses incorporate accounting software to strengthen your computer literacy, and provide you with up-to-date technical skills, which are essential in this field. Whether you decide to hire outside help or not, it’s important that you understand your part in this big responsibility. Even with a hired accountant, you’ll still need to organize your time and resources appropriately. Do so by setting aside an allocated amount of time to tend to this every week or month in order to make it a priority.

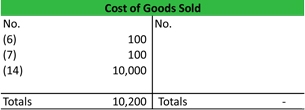

By law, accountants representing all publicly traded companies must comply with GAAP. In accounting terms, profit — or the “bottom line” — is the difference between your income, COGS, and expenses (including operating, interest, and depreciation expenses). COGS or COS is the first expense you’ll see on your profit and loss (P&L) statement and is a critical component when calculating your business’s gross margin. Reducing your COGS can help you increase profit without increasing sales. Accruals are credits and debts that you’ve recorded but not yet fulfilled.

This is the process of entering data into an accounting system, including the amount, date, and source of each revenue or expense. Software can simplify your bookkeeping by avoiding double (or triple) entries of data. You log it in here and the system will put it there, where you’ll need it another day.

Students integrate and apply their knowledge of fundamental accounting and taxation to complete various tasks using professional business writing skills and computer software. Payroll and statutory compliance reporting is mandatory for every business to adhere to. Students learn how to apply payroll legislation to calculate deductions, net pay, and remittances, and complete year-end payroll reporting. Students are introduced to the different types of requirements with which businesses are expected to comply, including GST/HST, QST, EHT and workers’ compensation. Through a combination of theory and practical activities, students prepare these submissions and calculations by reading through relevant legislation and completing activities. Accounting refers to the systematic and detailed recording of financial transactions of a business.

What is accounting?

If you plan on spending a lot on travel, for example, a business credit card that offers miles may be ideal. Review the payroll summary before payments are disbursed to avoid having to make corrections during the next payroll period. A payroll service provider can do all this to save you time and ensure accuracy at a reasonable cost. You can also use our free paycheque calculator to figure out what you need to withhold from each paycheque. Keep copies of all invoices sent, all cash receipts (cash, cheque and credit card deposits) and all cash payments (cash, cheque, credit card statements, etc.).

Accountants usually recommend the accrual basis to get a better picture of how your business is doing. This is one of the first questions you’ll have to decide when you set up your books. Wave makes money through our optional, paid money management features include online payment processing, payroll software, and access to personalized bookkeeping services and coaching through Wave Advisors. Having a separate bank account for your business income and expenses will make your accounting easier. You’ll only have one account to monitor for bookkeeping and tax purposes, and your personal income and expenses won’t get entangled with your business ones. Believe me — only having to look at one set of bank statements is a lifesaver during tax season.

Things get stirred around and you get the information you need to run your business. Third, the key to successful accounting is in the establishment of your accounting system and the reliable input of data. Recording the transactions and information is called bookkeeping, and it must be done regularly. You won’t get a good picture of your company if the paint (data) is stored in boxes in the basement.

Accounting is one of the most important elements to running a successful business – on top of being a legal obligation. Accounting software makes it possible to send invoices, reconcile bank transactions, pay your vendors and pay employees. The exact software you need will depend on the type of business you run and the specific features you want. If accounting isn’t one of your strengths but you have to manage this aspect of your business, there are numerous tools on the market that can help you. And the best place to start is by investing in accounting software.

You’ll need to determine if you operate your business in an origin-based state or a destination-based state. In the former, you must charge sales tax based on the state where you run your business. Business accounting The latter requires sales tax to be applied based on the purchaser’s location. However, when you sell online, customers may be located in different cities, states, provinces, and even countries.